2025 Indiana State Income Tax Rate

2025 Indiana State Income Tax Rate. That means that your net pay will be $44,148 per year, or $3,679 per month. Lake county indiana income tax rate 2025.

Lake county tax jurisdiction breakdown for 2025. Income tax tables and other tax information is sourced from the indiana department of.

Dor Guia De Servicios Para Contribuyentes Individuales (Dor Services.

1001, enacted in may 2023, indiana accelerated its previously enacted tax rate reductions, lowering the individual income tax rate from 3.15 in 2023 to.

34 States Have 2025 State Tax Changes Taking Effect On January 1St, Including State Income Tax Changes And State Business Tax Changes.

Indiana governor eric holcomb signed into law hb 1002 that lowers the personal income tax rate from the current 3.23% to 3.15% in 2023 and 2025.

The Indiana State Tax Calculator (Ins Tax Calculator) Uses The Latest Federal Tax Tables And State Tax Tables For 2025/25.

Images References :

Source: www.youngresearch.com

Source: www.youngresearch.com

How High are Tax Rates in Your State?, Updated on apr 24 2025. The statewide sales tax is 7% while the effective.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Indiana State Tax Withholding Calculator Internal Revenue Code, Hb 1002, enacted in 2022, lowered the personal income tax rate from 3.23% to 3.15% for tax years 2023 and 2025. Dor ha traducido la siguiente información para beneficio de nuestros clientes de habla español.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2025 Elene Hedvige, State income tax rates can raise your tax bill. Calculate your indiana state income taxes.

Source: www.zrivo.com

Source: www.zrivo.com

Indiana State Tax 2023 2025, Lake county tax jurisdiction breakdown for 2025. However, many counties charge an additional income tax.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, Calculating your indiana state income tax is a straightforward process, mainly since indiana uses a flat tax rate system. The indiana department of revenue (dor) keeps comprehensive records of county tax rates, dating back to 2007.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, Calculating your indiana state income tax is a straightforward process, mainly since indiana uses a flat tax rate system. The indiana department of revenue (dor) keeps comprehensive records of county tax rates, dating back to 2007.

Source: trybeem.com

Source: trybeem.com

Indiana State Tax Rates and Who Pays in 20232024, Income from $ 11,600.01 : Instead, it taxes all capital gains as ordinary income, using the same rates and brackets as the regular state income tax.

Source: taxedright.com

Source: taxedright.com

Indiana State Taxes Taxed Right, Dor guia de servicios para contribuyentes individuales (dor services. Estimate your tax liability based on your income, location and other conditions.

Source: upstatetaxp.com

Source: upstatetaxp.com

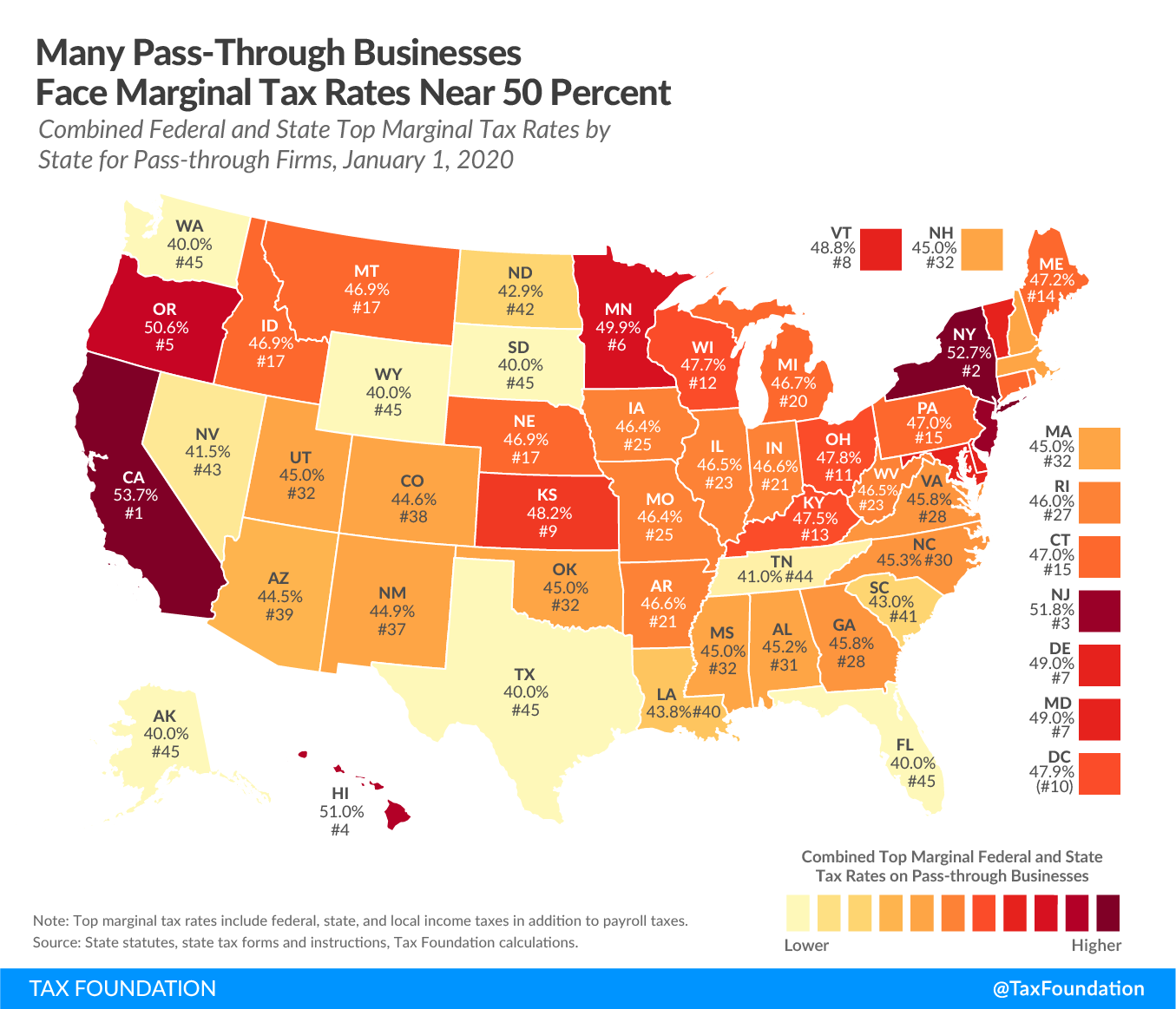

Marginal Tax Rates for Passthrough Businesses by State Upstate Tax, Based on the lowest, average, or highest tax brackets. Calculating your indiana state income tax is a straightforward process, mainly since indiana uses a flat tax rate system.

Source: raniquewlexie.pages.dev

Source: raniquewlexie.pages.dev

Tax Brackets 2025 What I Need To Know.Gov Milka Suzanna, County income tax rates may be adjusted in january and october. Dor guia de servicios para contribuyentes individuales (dor services.

The Statewide Sales Tax Is 7% While The Effective.

Indiana is one of the states with a flat.

Compare Relative Tax Rates Across The U.s.

If you make $55,000 a year living in the region of indiana, usa, you will be taxed $10,852.